lexington ky property tax rate

The median property tax on a 11780000 house is 84816 in Kentucky. The typical homeowner in Boone County pays 1778 annually in property taxes.

Property Tax By County Property Tax Calculator Rethority

For the general fund the tax rate will remain 8 cents for every 100 of assessed real property and 9 cents for every 100 of personal property.

. Various sections will be devoted to major topics such as. AP The rising value of used vehicles during the pandemic may lead to a hefty increase in property taxes on them Kentucky officials said. New LexServ office serves citizens.

How could this page be better. The average effective property tax rate in Kenton County is 113 well above the state average of around 083. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. What is the sales tax rate in Lexington Kentucky. You may obtain.

Please enclose a check or money order payable to Fayette County Sheriff along with your tax bill coupon. Office of the Fayette County Sheriff PO Box 34148 Lexington KY 40588-4148 Please enclose a check or money order payable to Fayette County Sheriff along with your tax bill coupon. Ad Research Is the First Step to Lowering Your Property Taxes.

Downloadable 2016-2017 Tax Rates. A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky. The city establishes tax levies all within the states statutory directives.

Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. The minimum combined 2022 sales tax rate for Lexington Kentucky is. Kentucky is ranked 880th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Mayor Jim Gray today opened a new payment office to make it more convenient for. Did South Dakota v. The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200.

Lexington County explicitly disclaims any representations and warranties including without. Kentucky has 120 counties with median property taxes ranging from a high of 224400 in Oldham County to a low of 29300 in Wolfe County. Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving customer service efficiency.

This estimator is based on median property tax values in all of Kentuckys counties which can vary widely. Browse Current and Historical Documents Including County Property Assessments Taxes. 072 of home value.

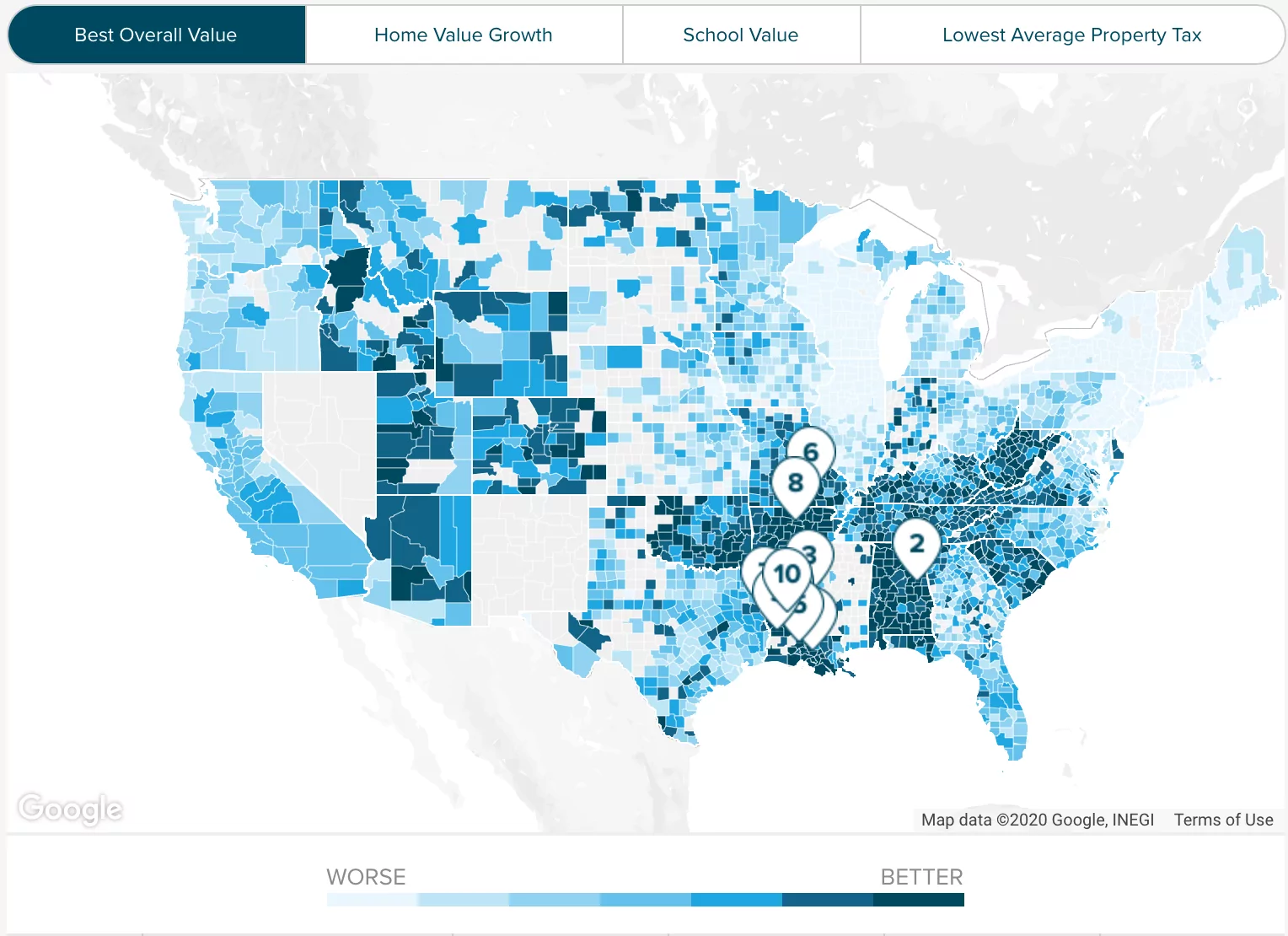

For more details about the property tax rates in any of Kentuckys counties choose the county from the interactive map or the list below. The Lexington sales tax rate is. If you cannot enclose a tax bill coupon please write the tax bill number.

Downloadable 2017-2018 Tax Rates. Downloadable 2018-2019 Tax Rates. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky.

Tax amount varies by county. Downloadable 2021-2022 Tax Rates. Wayfair Inc affect Kentucky.

That is considerably less than the national median 2578 but is much higher than the state median of 1257. David ONeill Property Valuation Administrator 859 246-2722. Limestone Ste 265 Lexington KY 40507 Tel.

The average yearly property. Property Tax Search - Tax Year 2021. 1 225 of each individuals gross wages salaries commissions and other compensation including deferred compensation and employee contributions to Cafeteria Plans under Section 125 of.

On April 18 2022 the Fayette County Sheriff will turn over the unpaid tax bills to the County Clerks Office. What is Lexington city tax. Property not exempted has to be taxed equally and consistently at present-day values.

Remember not to include sensitive personal information. July 6 2021The Kentucky Department of Revenue DOR has set the 2021 State Real Property Tax Rate at 119 cents per 100 of assessed value. Apr 24 2017 1054 am.

Pay Fayette County Kentucky Property Taxes online using this service. For a more specific estimate find the calculator for your county. Downloadable 2015-2016 Tax Rates.

The median property tax on a 11780000 house is 123690 in the United States. Downloadable 2020-2021 Tax Rates. If you do not receive a tax bill in the mail by the second week of November please contact our office at 502-574-5479 and request a duplicate bill to be sent to you.

During the tax sale the delinquent tax bills are eligible to be purchased by a third party. You may also print a copy of your tax bill by using the Property Tax Search and Payment. The reader should not rely on the data provided herein for any reason.

If you cannot enclose a tax bill coupon please write the tax bill number account number and property address on your check or money order. 859-252-1771 Fax 859-259-0973. Downloadable 2014-2015 Tax Rates.

Fayette County collects on average 089 of a propertys assessed fair market value as property tax. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. Overall the 2022 valuation increases for vehicles compared to vehicles the same time last year is up approximately 40 percent Kentucky Department of Revenue director of valuation Cathy Johnson said in a.

Every year tax bills are mailed in November. Their phone number is 859 254-4941. Public Property Records provide information on land homes and commercial properties in Lexington including titles property deeds mortgages property tax assessment records and other documents.

Find Lexington Property Records. A citys real estate tax regulations should comply with Kentucky constitutional rules and regulations. The assessment of property setting property tax rates and the billing and.

Local Property Tax Rates. Office of the Fayette County Sheriff. Owners rights to timely notice of tax levy hikes are also obligatory.

Lexingtons plans may surprise you. The County sales tax rate is. This is the total of state county and city sales tax rates.

To view all county data on one page see Kentucky property tax by county. The Kentucky sales tax rate is currently. Downloadable 2019-2020 Tax Rates.

Each year the County Clerks Office is responsible for conducting a tax sale on the delinquent tax bills. Enter Your Address to Begin. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

Suggestions or problems with this page. Kentucky has one of the lowest median property tax rates in the United States with only seven states.

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Property Taxes By County 2022

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage First Time Home Buyers Mortgage Tips

Kentucky League Of Cities Infocentral

Property Tax By County Property Tax Calculator Rethority

/cloudfront-us-east-1.images.arcpublishing.com/gray/TUVVIBDBGVBTVGKC2GZHHE432M.png)

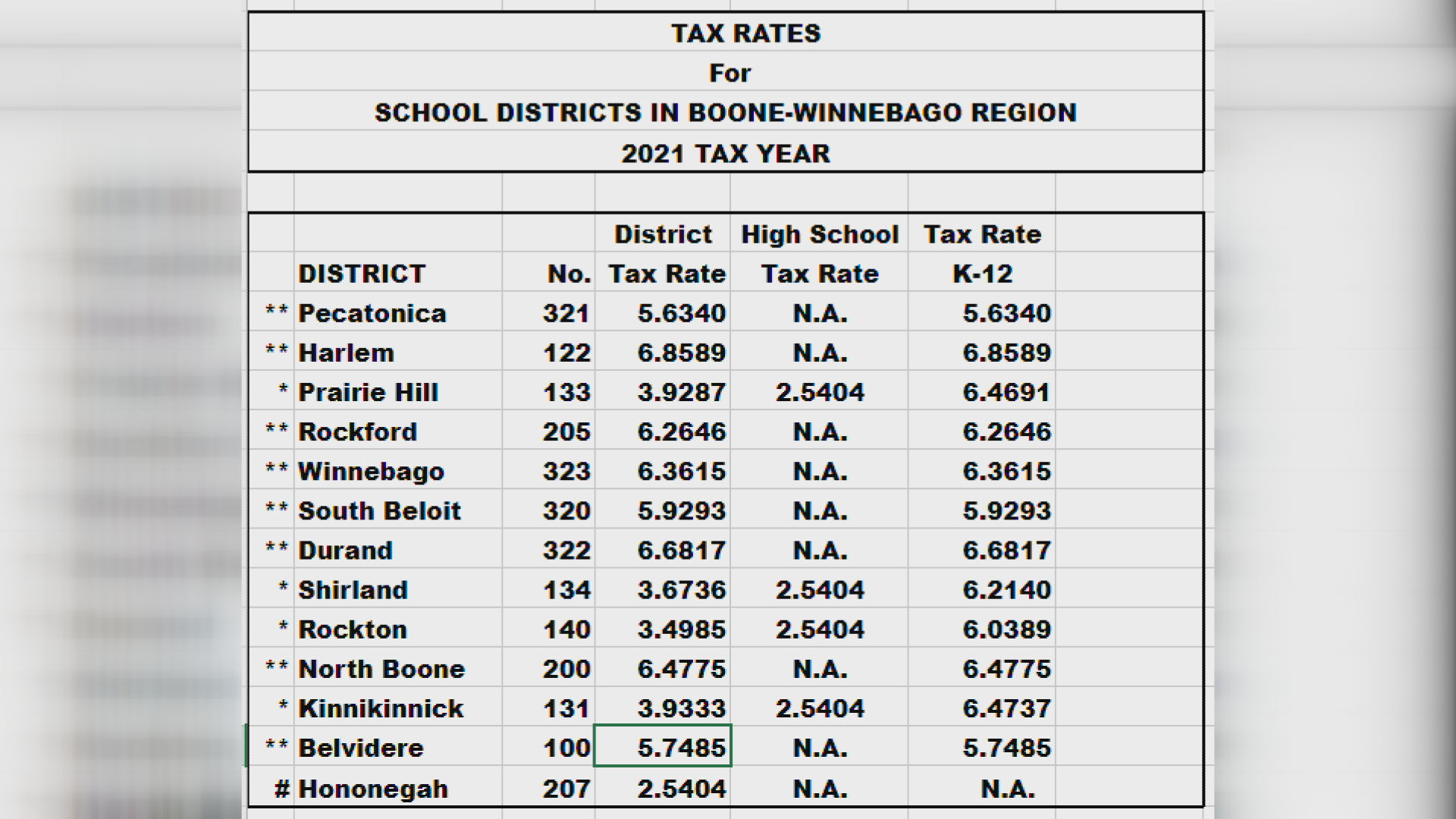

Property Tax Rates Released For Stateline School Districts Put Harlem In Top Spot

Property Tax By County Property Tax Calculator Rethority

/cloudfront-us-east-1.images.arcpublishing.com/gray/TUVVIBDBGVBTVGKC2GZHHE432M.png)

Property Tax Rates Released For Stateline School Districts Put Harlem In Top Spot

Kentucky Property Tax Calculator Smartasset

/cloudfront-us-east-1.images.arcpublishing.com/gray/TUVVIBDBGVBTVGKC2GZHHE432M.png)

Property Tax Rates Released For Stateline School Districts Put Harlem In Top Spot

Property Tax Rates Released For Stateline School Districts Put Harlem In Top Spot

First Time Home Buyer Lending Vocab Www Abodeagency Net First Time Home Buyers Home Buying Process Vocab

Buying A Home Isn T Just A 20 Down Payment And A Monthly Check For The Mortgage Here Are 9 Hidden Co Buying First Home Home Buying Checklist First Home Buyer

Property Tax By County Property Tax Calculator Rethority

Kentucky Property Tax Calculator Smartasset

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville